Register Online Through e-Daftar. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

How To File Income Tax In Malaysia Using E Filing Mr Stingy

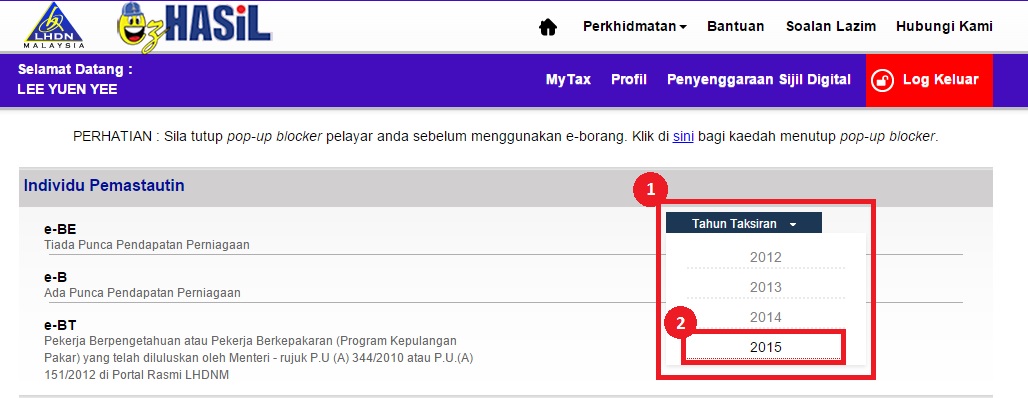

Choose the right income.

. Monthly Tax Deduction MTD as Final Tax has been enforced starting from the Year Assessment of 2014 whereby individuals with employment income and MTD have the option not to furnish. Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia. Individuals earning more than RM34000 per annum or approximately RM283333 per month after EPF deductions are required to file a tax return with the government.

Register for first-time taxpayer online via LHDN MalaysiaA. Click on Next to submit your. Click on the e-Daftar.

Here is the step-by-step guide for the e-Filing process. Login to e-Filing website. Go to e-Filing website.

Who Is Required to Pay Income Taxes. Ensure that your personal information is correct. Companies limited liability partnerships trust bodies and cooperative societies which are.

Click on Application followed by e-Filing PIN Number Application in the left menu. Once the new page has loaded click on the relevant income tax. Register for first-time taxpayer online via LHDN MalaysiaA.

The documents you will need. Pengesahan ini boleh didapati melalui. Go to e-Filing website.

The tax year in Malaysia runs from January 1st to December 31st. Click on e-Daftar. Ensure you have your latest ea form with you 3.

The following entities and accounting firms in Malaysia must file their taxes. Pay tax instalments if a profit is forecasted in the coming year. Right-click the files icon.

Click More Info Find the file type listed under. Go through the instructions carefully. An individual who earns an annual income exceeding rm41000from malaysia must register a tax.

Click on ezHASiL. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account Register for your.

Tax or tax data file not the PDF select it and then select. Click on Form CP55D and fill in the PDF form. Here is the step-by-step guide for the e-Filing process.

List of Tax Exemption in Malaysia Year of Assessment 2021 e-Filing 2022 For resident individuals as updated on 11 January 2022 1. Click Properties Find the file type listed under Type of File Using a Mac. They need to apply for registration of a tax file.

Thus those who want to open a company in Malaysia as a subsidiary have to file financial. You must be wondering how to start filing income tax for the. Select Open Tax Return from the File menu Windows or TurboTax menu.

The first part is about the preparation and things you SHOULD know before filing your tax retu. How much salary is taxable in Malaysia. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing.

Visit the official Inland Revenue Board of Malaysia website. On the other way. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

A business or company which has employees and fulfilling. PEJABAT HASiL KEDAH KELANTAN TERENGGANU DAN JOHOR KEMBALI. Where a company commenced operations.

Login to e-Filing website. Right-click the files icon. This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia.

Guide To Using Lhdn E Filing To File Your Income Tax

How To File Your Taxes For The First Time

Jual Paket Tour Libur Sekolah 2022 Shopee Indonesia

Pdf Tax Avoidance Corporate Governance And Firm Value In The Digital Era

Guide To Using Lhdn E Filing To File Your Income Tax

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

A Guide To Personal Income Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Guide To Using Lhdn E Filing To File Your Income Tax

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

How To File Your Taxes For The First Time

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My