The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Equally to each individual.

Property Tax Definition Property Taxes Explained Taxedu

What is the Per Capita Tax.

. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. What is the Per Capita Tax. Normally the Per Capita tax is NOT.

Per curiam by the court. 39-16-104a and b as determined by the department for the fiscal year beginning July 1 2004 and ending June 30 2005 divided by two 2 and multiplied by the proportion the population of. Define Adjusted net tax capacity per capita.

Definition of per capita. GDP per capita is a measurement used to determine a countrys economic output about how many people live in the country. It means to share and share alike according to the number of individuals.

Means the total assessed value for the state for the 2014 tax year multiplied. Anticipated county property tax revenue availability. Means the total assessed value within each county for the 2014 tax year multiplied by twelve.

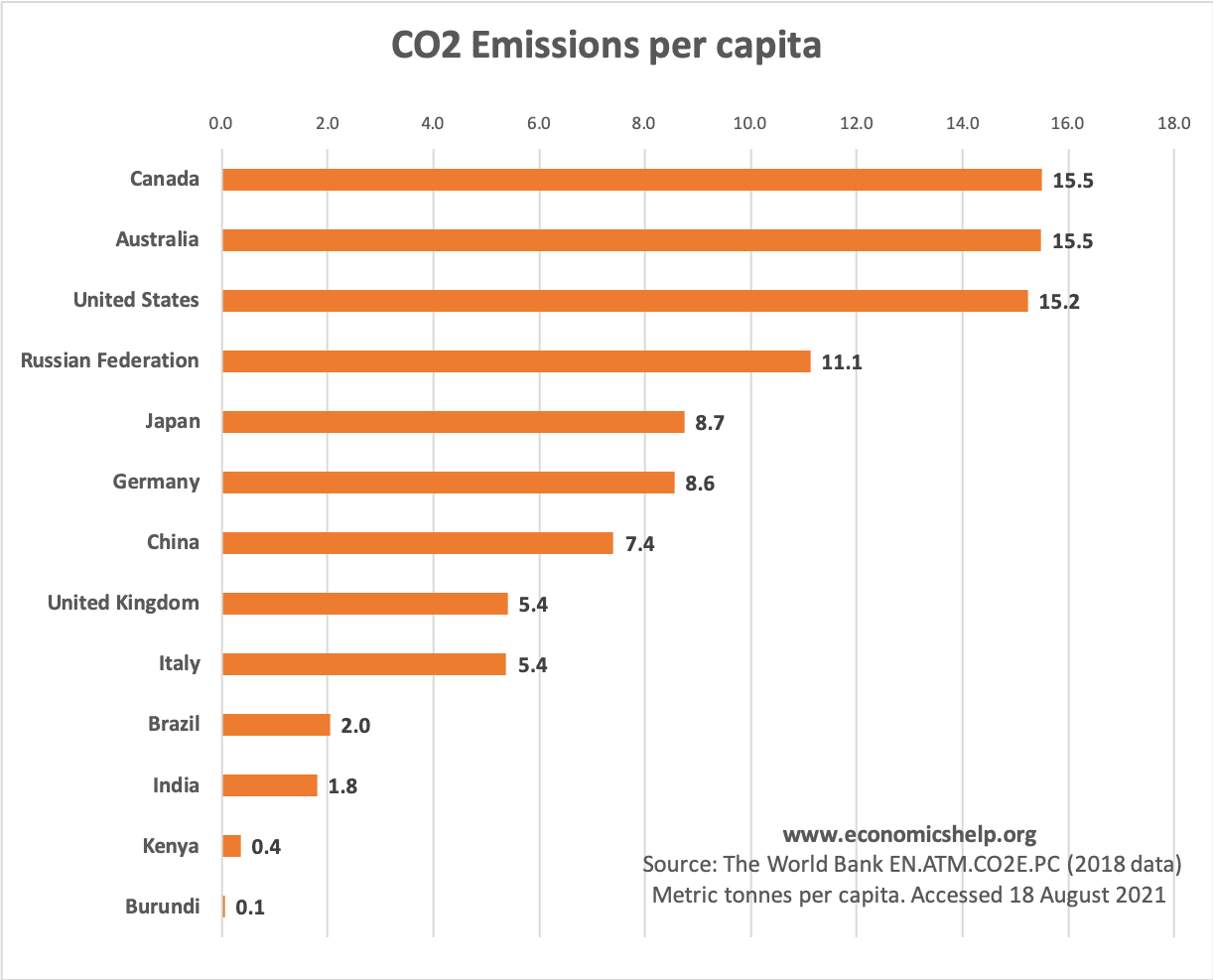

With data from 2018 we can see that unquestionably countries with higher taxes have higher income per capita. Define Per capita potential city or town sales and use tax revenue. Through the agency of.

The difference is quite striking but it allows businesses to make decisions that suit them. I am a Phoenixville resident. For instance the GDP per capita in California was over 70000 in 2019 whilst it was just over 41000 in Alabama.

Gross domestic productpopulation GDP per capita. Per capita helps businesses identify income levels in different parts of the country whilst making a like for like comparison. Define Per capita potential statewide county ad valorem tax revenue.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Do I pay this tax if I rent. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property.

For approximately every percentage point by which the tax. Prepared by the author with data from the International Monetary Fund IMF. In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent.

In other words if you live in an. Means the jurisdictions adjusted net tax capacity divided by its population. By or for each person the highest income per capita of any state in the union.

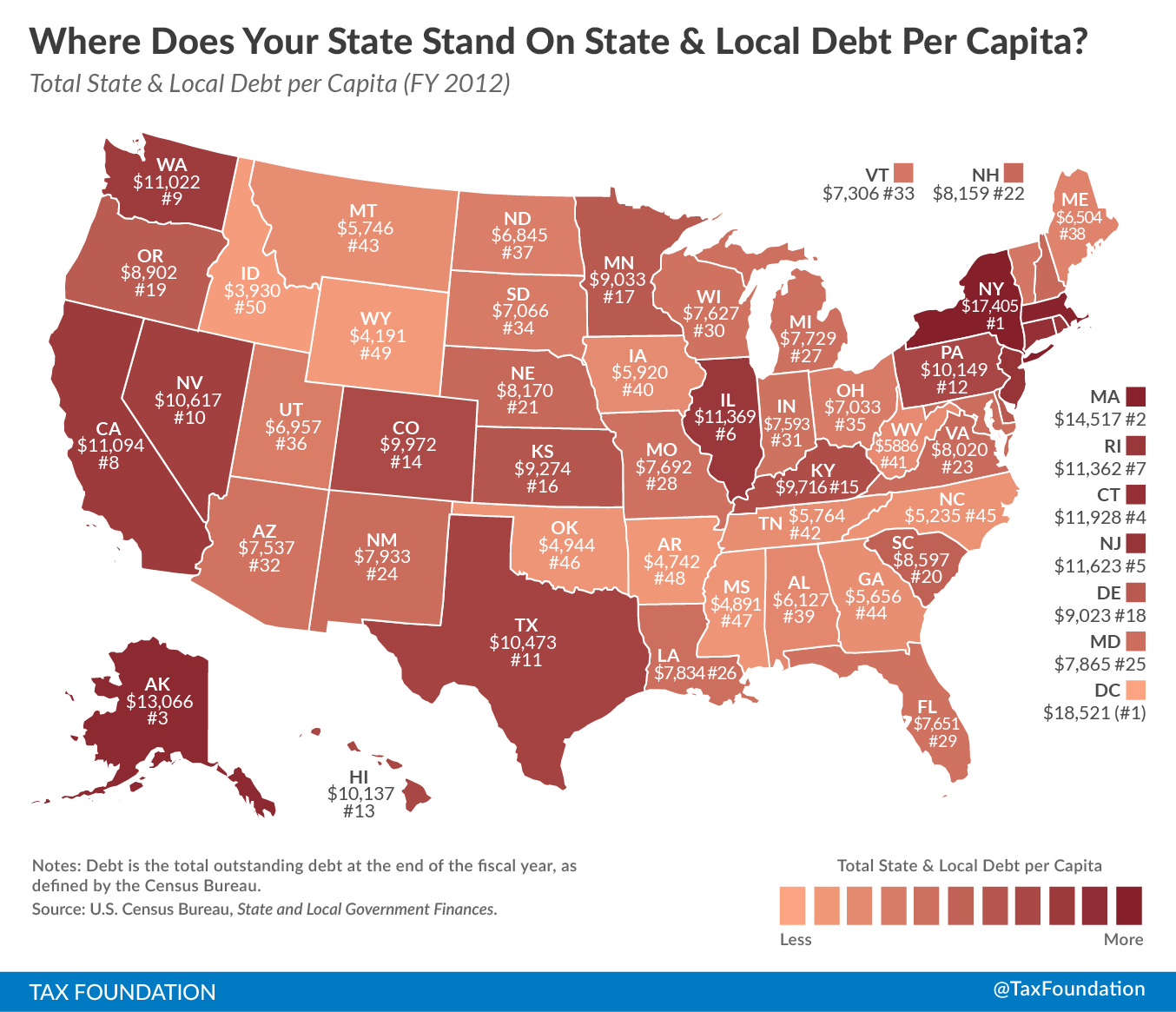

Per is also sometimes used with English words. Means the states net tax supported debt as determined by the division divided by the most recently available population estimate for the state by the United States department of commerce. County-adjusted property tax.

39-15-104a and b and under WS. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Search Within Per capita potential county ad valorem tax revenue Definitions. Is this tax withheld by my employer. How do I file a request for exemption from the per capitaoccupation tax.

Define Per capita potential county ad valorem tax revenue. Per se by itself of itself. Means the sales and use taxes collected in each county from the taxes imposed under WS.

Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will. Synonyms More Example Sentences Learn More About per capita. Per capita income helps determine the average per-person income to evaluate the standard.

The GDP of a country is calculated by dividing a countrys total domestic output by its population. Define Net tax supported debt per capita. The Per CapitaOccupational Assessment Tax is also known as Personal Tax.

Search Within Per capita potential statewide county ad valorem tax revenue Definitions. Net tax per capita means the adjusted net tax capacity of all taxable real property in the city or town or county divided by the total population of that city town or county. Per unit of population.

The formula for GDP is as follows. It is not dependent upon employment. Anticipated county property tax revenue availability.

Keep in mind that tax burdens are equal to tax revenue divided by total economic output. Per capita by heads or according to individuals. For most areas adult is defined as 18 years of age or older.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. Per capita income is a measure of the amount of money earned per person in a nation or geographic region.

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Burundi Gdp Per Capita Current Dollars Data Chart Theglobaleconomy Com

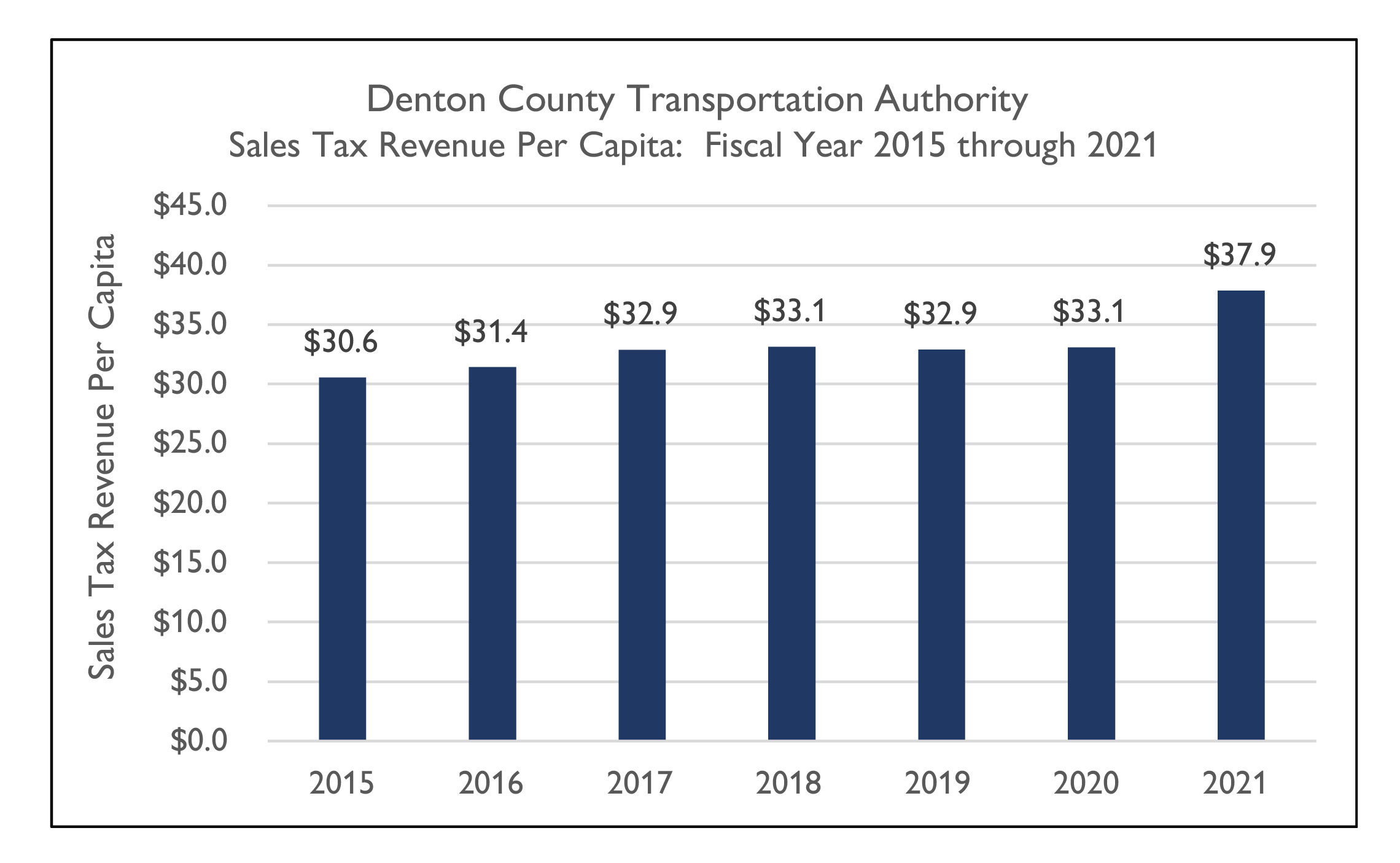

Financial Information Transparency Dcta

How Is Tax Liability Calculated Common Tax Questions Answered

Usa Gdp Per Capita Constant Dollars Data Chart Theglobaleconomy Com

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Property Tax Definition Property Taxes Explained Taxedu

Per Capita Definition Formula Examples And Limitations Boycewire

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_Purchasing_Power_Parity_PPP_May_2020-01-d820977667e14964ab1b3538e0af520c.jpg)

What Is Purchasing Power Parity Ppp

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Information About Per Capita Taxes York Adams Tax Bureau

Understanding California S Sales Tax

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)